FSCM – Credit Management Migration: Transitioning from FI-AR-CR to FIN-FSCM-CR in SAP S/4HANA

FSCM – Credit Management Migration: Transitioning from FI-AR-CR to FIN-FSCM-CR in SAP S/4HANA

With SAP S/4HANA, traditional Credit Management (FI-AR-CR) is no longer supported, requiring businesses to transition to SAP Credit Management (FIN-FSCM-CR). If you are converting your system from SAP ERP to SAP S/4HANA and currently using Credit Management (FI-AR-CR), a structured migration approach is mandatory. The essential activities to ensure a smooth transition to SAP Credit Management are ensured by the following guide.

Key Migration Phases

The migration process occurs after completing the technical system conversion to SAP S/4HANA (SUM run) and consists of the following mandatory phases:

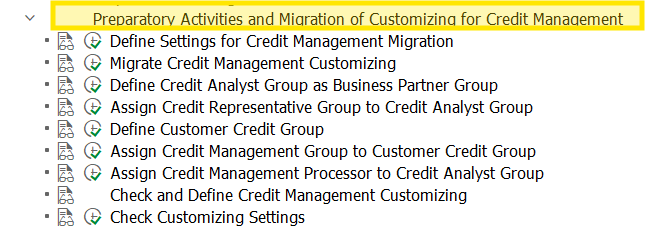

1. Preparatory Activities & Migration of Customizing Settings

Before migrating credit management data, the following mandatory configuration tasks must be completed:

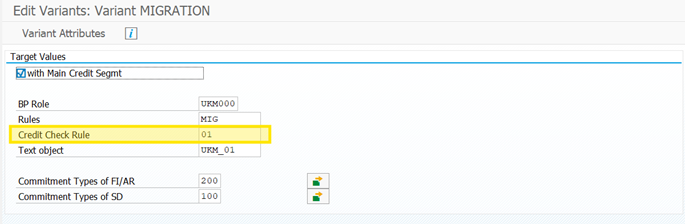

A) Defining Settings for Credit Management Migration (Mandatory)

This step establishes target values for Credit Management, ensuring that business partners are updated accordingly after migrating master data. Organizations must define custom check rules based on their business needs.

B) Migrate Credit Management Customizing (Mandatory)

This step transfers FI-AR Credit Management configurations to the new SAP Credit Management framework.

The following key settings are migrated:

- Credit control areas are mapped to credit segments - A new credit segment with the same ID is created for each credit control area and assigned accordingly.

- The Conversion of Risk categories to Risk classes - A new risk class with the same ID is created for each risk category and assigned accordingly.

- Note: In FIN-FSCM, a business partner has only one risk class for all segments. The customer should have a consistent risk category across all credit control areas to ensure accurate migration of the risk class.

- Required configurations for documented credit decisions are implemented.

- Automatic credit control settings (OVA8) are applied.

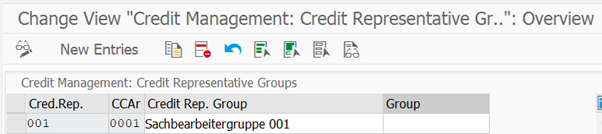

C) Define Credit Analyst Group as Business Partner Group (Optional)

In SAP S/4HANA, the Credit Representative Group from SAP ECC is replaced by the Credit Analyst Group. Unlike in ECC, where the Credit Representative Group is assigned per credit control area, the Credit Analyst Group in S/4HANA is created as a Business Partner with the category "Group".

As part of the Customizing process, a Credit Analyst Group must be defined as a business partner of type "Group." In the next step, this group can be linked to a Credit Representative Group. For each Credit Analyst Group, a corresponding business partner must be created with the "Group" category.

D) Assign Credit Representative Group to Credit Analyst Group (Optional)

This step links the newly created credit analyst group to the existing credit representative group for each credit control area.

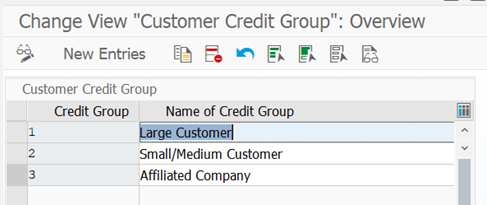

E) Defining the Customer Credit Group (Optional)

Customer credit groups enable the classification of business partners into categories such as domestic, foreign, regular, or insured customers and serve as selection criteria for reporting and worklist creation.

F) Assign Credit Management Group to Customer Credit Group (Optional)

In this step, businesses define groups for each credit control area and later assign customers accordingly within the credit management master data.

G) Assign Credit Management Processor to Credit Analyst Group (Mandatory)

The Credit Management Processor is designated as a business partner of type "Person" with the "Employee" role. To establish the relationship between a Credit Management Processor and a Credit Analyst Group, use relationship category UKMSBG.

- In the "Business Partner 1" field, enter the Credit Analyst Group.

- In the "Business Partner 2" field, enter the Credit Management Processor (representing an employee).

Prerequisite: It is mandatory to consider Simplification Item 2570961 (Business User Management) before performing this assignment.

H) Reviewing Customization Settings (Mandatory)

To ensure that all credit management configurations are correctly set up for migration, a system check is performed. If any settings are missing or incorrectly configured, the system would generate warnings or errors.

Important Note: Credit check types A, B, and C are not supported in S/4HANA. They must be replaced with type D (Credit Management: Automatic Credit Control) or left blank in OVA8, If any of these types are assigned.

2. Credit Management - Data Migration

The actual data migration begins once the customizing settings are prepared:

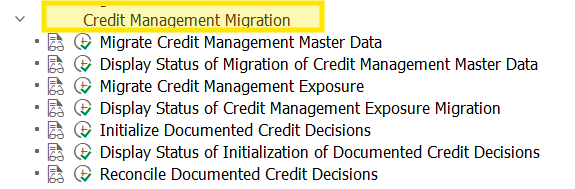

A) Migrate Credit Management Master Data (Mandatory)

In SAP S/4HANA, the Credit Management master data from Accounts Receivable (FI-AR) is transferred to SAP Credit Management under Financial Supply Chain Management (FIN-FSCM-CR).

This migration is performed for each credit control area customer, covering :

- Credit limits

- Customer credit groups

- Credit representative groups

- Text fields

- Risk categories

These elements are migrated based on their respective Customizing assignments.

Execute this step to transfer the Credit Management master data. You can manage the credit management master data using transaction UKM_BP once the migration is complete.

B) Display Status of Credit Management Master Data Migration (Mandatory)

This step provides a detailed overview of whether the migration for each customer and credit control area has been successfully carried out, ensuring that critical data elements like credit limits, customer credit groups, credit representative groups, and risk categories are accurately transferred.

C) Migrate Credit Management Exposure (Mandatory)

Two crucial steps help us in the migration of Credit Management exposure in SAP S/4HANA.

Transfer of Credit Values:

The first step involves transferring the credit values from open orders and deliveries to the credit exposure. This ensures that any outstanding amounts tied to orders and deliveries are reflected in the credit management system.

Recalculation of Payment Behavior:

The payment behavior data is recalculated using the information from Accounts Receivable (FI-AR). This ensures that historical payment patterns are accurately captured and incorporated into the credit exposure calculations.

Executing this migration step allows for the proper transfer and recalculation of credit exposure. After completing the migration, transaction UKM_BP will be used to view and manage credit exposure moving forward.

D) Display Status of Credit Management Exposure Migration (Mandatory)

In SAP S/4HANA, after migrating the Credit Management exposure, it is crucial to verify the success of the recalculation of commitments and payment behavior. The Display Status of Credit Management Exposure Migration activity in Customizing allows users to monitor and confirm the status of this recalculation.

This step focuses on checking the status of:

- Commitments: Ensuring that the credit values from open orders and deliveries have been correctly transferred to the credit exposure.

- Payment Behavior: Verifying that the payment behavior data, recalculated using Accounts Receivable (FI-AR) data, has been accurately updated.

E) Initialize Documented Credit Decisions (Mandatory)

In SAP S/4HANA, sales and delivery documents that are blocked by credit management are managed through documented credit decisions. By making documented decisions regarding their release or rejection, this process helps businesses handle blocked documents.

Prerequisites: Before initializing documented credit decisions, review and update the relevant Customizing settings under the following path: Financial Supply Chain Management → Credit Management → Credit Risk Monitoring → Documented Credit Decision. Keep in mind, the necessary configurations are in place.

You can use transaction UKM_CASE after initialization, to:

- Recheck Blocked Documents: Verify the current status of blocked sales and delivery documents.

- Release or Reject Documents: Make decisions on whether the blocked documents should be released or rejected based on the credit management evaluation.

F) Display Status of Documented Credit Decision Initialization (Mandatory)

In SAP S/4HANA, the Display Status of Documented Credit Decision Initialization activity allows you to verify the status of sales and delivery documents that were blocked due to credit management. This step is crucial to ensure the successful migration and proper handling of these blocked documents.

You can confirm that the migration of blocked sales and delivery documents has been completed correctly and that all credit decisions have been appropriately recorded, by using this activity.

G) Reconcile Documented Credit Decisions (Mandatory)

The Reconcile Documented Credit Decisions activity in SAP S/4HANA allows you to verify that a documented credit decision has been recorded for every sales and delivery document that was blocked due to credit management.

This step ensures that all blocked documents have an associated credit decision, confirming that the appropriate actions have been taken for each document. It helps maintain consistency and transparency in managing blocked sales and delivery documents within the credit management system.

Concluding words

Businesses can successfully transition from FI-AR-CR to FIN-FSCM-CR in SAP S/4HANA by completing these mandatory migration steps. Ensuring accurate customizing, data migration, and validation will help optimize credit management processes and leverage the enhanced functionalities offered by SAP Credit Management.

Your message has been sent successfully.